Reasons Why You Should Get Health Insurance in Today’s Changing Times

- Which health insurance is the best?

The "best" health insurance plan will vary depending on a number of criteria, including personal preferences, healthcare provider network, budget, and individual needs. There isn't a universal solution because what suits one individual may not be the ideal choice for another. However, here are some considerations to help you choose a health insurance plan:

-

Coverage Needs: Assess your healthcare needs, including medical conditions, prescription medications, and anticipated medical services. Select a plan that offers sufficient coverage for the medical demands.

-

Network of Providers: Check if the health insurance plan has a network of healthcare providers, including hospitals, doctors, specialists, and pharmacies, that are conveniently located and accessible to you.

-

Costs and Premiums: Consider the coinsurance, copayments, deductibles, and premiums associated with the health insurance plan. To select a plan that fits your budget well, compare the prices of several options.

-

Coverage Options: Examine the alternatives for preventive care, emergency services, hospitalization, prescription medication, mental health services, and maternity care that are provided by the health insurance plan.

-

Financial Stability and Reputation: Research the financial stability and reputation of the health insurance company. Customer satisfaction surveys to assess the company's dependability and service quality while looking at reviews, ratings.

-

Additional Benefits: Wellness programs, telemedicine services, coverage for alternative medicine, and savings on medical services are just a few of the extra perks that some health insurance policies provide. Take into account these extra advantages while contrasting programs.

-

Policy Exclusions and Limitations: Read the policy documents carefully to understand any exclusions, limitations, or restrictions on coverage. Make sure that what is not covered by the health insurance plan and Make sure that what is covered.

-

Government Programs: If you qualify, research publicly funded health insurance plans such as Medicaid, which serves low-income individuals and families, and Medicare, which is available to seniors 65 years of age and older.

The ideal health insurance plan for you will ultimately rely on your unique objectives and circumstances. It's advisable to research and compare multiple health insurance options before making a decision. Additionally, consulting with a licensed insurance agent or broker can provide valuable guidance and help you navigate the complexities of health insurance.

- Which health insurance is best for claim?

A number of elements, including customer service, network of healthcare providers, claim settlement ratio, and convenience of the claim procedure, must be taken into account when choosing the best health insurance for claim purposes. Here are some health insurance companies in India known for their good claim settlement records and customer satisfaction:

-

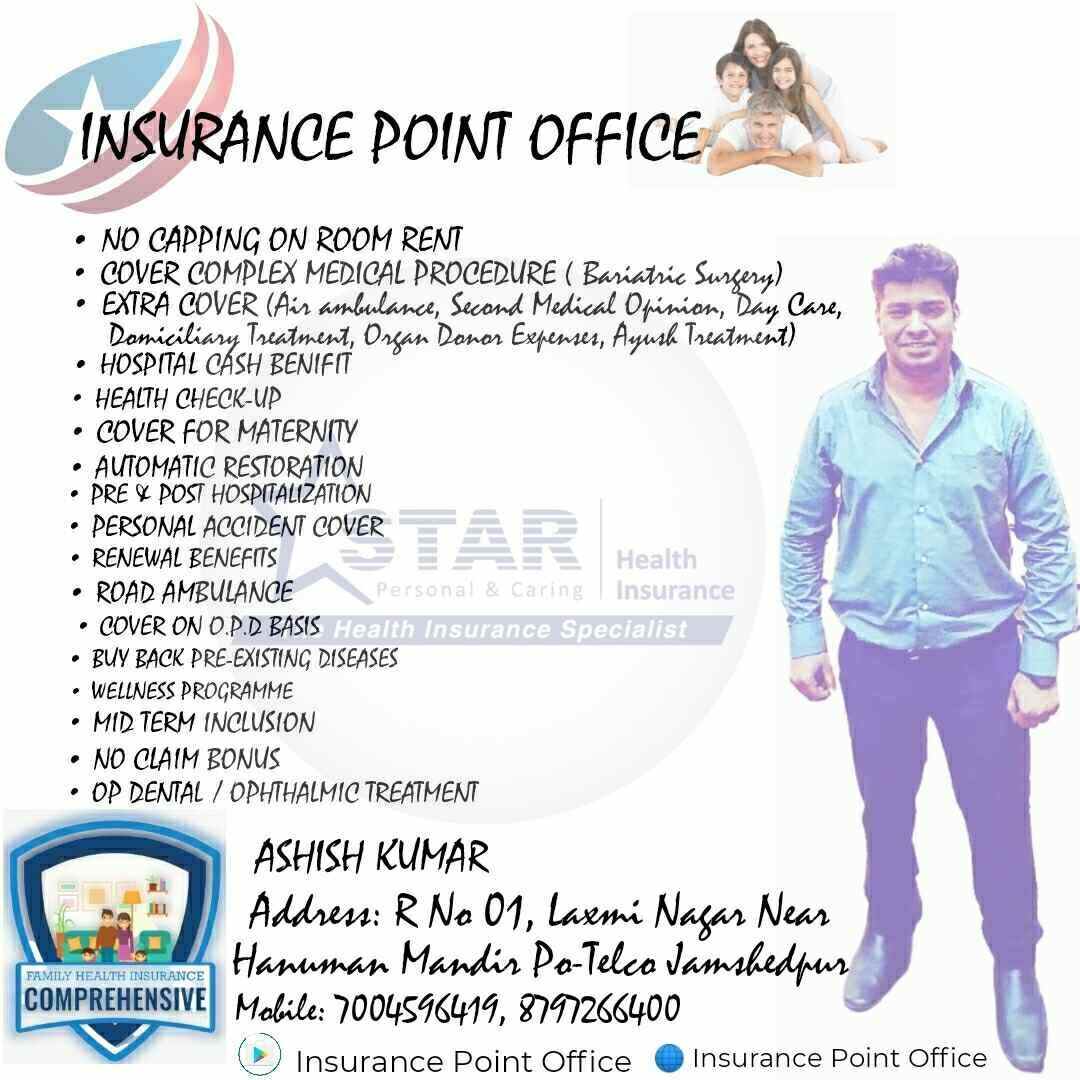

Star Health and Allied Insurance: Known for its wide hospital network and quick claim settlement procedure, Star Health is one of the top health insurance carriers in India.

When choosing a health insurance plan, factors other than the claim settlement % should be taken into account. The hospital network, coverage options, premium prices, and client feedback are some of these variables. The terms and conditions, including exclusions and restrictions, to make sure the insurance meets your specific needs and expectations.

- What is benifits of having health insurance?

Financial protection against medical costs resulting from disease, accident, or other healthcare requirements is offered by health insurance. Its cover all healthcare services, including hospital stays, doctor visits, prescription medications, diagnostic tests, and preventative care.

Here's how health insurance works in healthcare:

-

Premium: Policyholders pay a premium to the health insurance company at regular intervals, typically monthly or annually. Age, health, available coverage are factors which affect this premium price.

-

Coverage: In exchange for the premium payments, the health insurance company provides coverage for specified healthcare services outlined in the policy. Pregnancy care, emergency care, outpatient services, inpatient hospitalization, and other medical procedures could all be covered.

-

Deductible: Many health insurance plans have a deductible, which is the amount that the policyholder must pay out-of-pocket before the insurance company starts covering medical expenses. Following the payment of the deductible, the policyholder is usually responsible for the remaining balance, with the insurance company covering a portion of the expenses (coinsurance or copayment).

-

Network of Providers: Health insurance plans often have a network of healthcare providers, including hospitals, doctors, specialists, and pharmacies, with whom they have negotiated discounted rates. Policyholders may receive full or partial coverage for services obtained within the network, and may have to pay higher out-of-pocket costs for services obtained outside the network.

-

Claim Process: When a policyholder seeks medical treatment covered by their health insurance policy, the healthcare provider submits a claim to the insurance company for reimbursement. The insurance company evaluates the claim based on the policy terms and, if approved, reimburses the healthcare provider for the covered services.

- Benefits: Health insurance provides financial protection against the high costs of medical care, helping individuals and families afford necessary healthcare services without facing significant financial hardship.

- Is Star Health Insurance good or bad?

- Claim Settlement Record: Check the claim settlement ratio of Star Health Insurance, which indicates the percentage of claims settled by the company compared to the total number of claims received. A higher claim settlement ratio typically indicates better reliability in honoring claims.

-

Coverage Options: Review the range of health insurance plans offered by Star Health Insurance and assess whether they align with your healthcare needs and budget. Consider the coverage limitations, perks, exclusions, and possible add-on options.

-

Network of Hospitals: Verify whether Star Health Insurance has a wide network of hospitals and healthcare providers in your area. Having access to a broad network can ensure that you receive timely medical care and benefit from cashless treatment facilities.

-

Customer Service: Research customer reviews and feedback about Star Health Insurance's customer service quality, responsiveness, and support during the policy purchase process, claim settlement, and other interactions.

-

Premium Affordability: Compare the premiums charged by Star Health Insurance with those of other insurance companies offering similar coverage. Evaluate whether the premiums are competitive and offer good value for the coverage provided.

- Policy Terms and Conditions: Make sure you understand what is and is not covered by carefully reading the terms and conditions of Star Health Insurance products, including coverage restrictions, waiting periods, pre-existing conditions, and exclusions.

In the end, how effectively Star Health Insurance satisfies your unique needs and expectations will determine whether you think favorably or poorly of it. Before choosing an alternative, it's a good idea to do a lot of research, weigh the pros and disadvantages of several insurance plans, and, if necessary, speak with a certified insurance expert. To select the best health insurance company for you, take into account additional aspects than reputation, such as policy features, perks, and level of customer service.

- Is Star Health owned by whom?

As of my last update in January 2022, Star Health and Allied Insurance Co. Ltd. is owned by a consortium of investors. This consortium includes top private equity companies including WestBridge Capital, Madison Capital, and Sequoia Capital, among others. These investors bought a big interest in Star Health Insurance in a transaction that occurred in 2018. It's crucial to note that ownership structures can change over time due to a number of factors, including mergers, acquisitions, and changes in ownership interests. Therefore, for the most current information on the ownership of Star Health Insurance, I recommend consulting recent financial reports, company announcements, or reliable news sources.

- What is the minimum amount for Star Health Insurance?

The minimum amount for Star Health Insurance, like any health insurance plan, can vary depending on several factors, including the type of plan, coverage options, age of the insured, and other individual factors. However, typically, health insurance plans have a minimum premium amount that policyholders need to pay to obtain coverage.

For Star Health Insurance, the minimum premium amount can depend on the specific health insurance product you choose and the coverage options selected. Individual health insurance plans, family health insurance plans, senior citizen health insurance plans, and group health insurance plans offered by Star Health Insurance may have different minimum premium amounts.

To determine the minimum premium amount for Star Health Insurance, it's advisable to contact Star Health Insurance directly or visit their official website to explore their various health insurance products and request a quote based on your specific requirements and preferences. Age, medical history, sum insured, and coverage restrictions can all have an impact on a health insurance policy's premium. Therefore, whether seeking a pricing estimate from Star Health Insurance or any other health insurance provider, it is imperative that you provide correct information.

Written By - Insurance Point Office